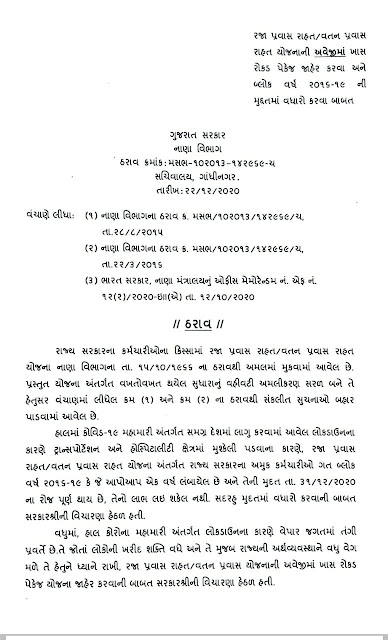

LTC BLOCK 2016-19 LATEST UPDATE FOR GOVERNMET OFFICERS

Government employees taking advantage of the Holiday Travel Exemption (LTC) may be encouraged to share any interesting insights and pictures of the places they have visited on the "appropriate platform", part of the LTC Rules updated by the Department of Personnel and Training (LPT). As proposed. And proceedings.

The proposal regarding the comments that will be given in the next fortnight, does not specify the "appropriate forum" on which government employees can post writings and photos of their LTC holidays. Sources, however, told TOI that insights and pictures may be submitted by government employees to their respective departments, which may later post them on their website.

The new Central Civil Services (LTC) rules seek to alleviate the hardships faced by government employees when applying for and resolving LTC claims. Determining external deadlines for various LTC processes, the DOPT on Monday said the LTC leave should not take more than five days in each for advance leave or clearance. This will be extended to two days where the government employee is away for headquarters.

In addition the administration will not take more than 10 days (12 where the employee is away from the headquarters) to verify the LTC claim after the LTC bill is introduced by the government employee.

Measures by the government to accelerate consumption demand by providing more money in the hands of individuals, only Rs. 300,000 to claim Rs. You have to spend more than 1 lakh.

According to the LTC fare schedule provided by the Ministry of Finance, a deemed airfare (round trip) for a person entitled to travel business class is Rs. 36 36,000 while those entitled for economy class air travel and rail travel (any class) are entitled to Rs. 50,000 and Rs. 6,000 respectively

This means that under the special cash package associated with LTC, a person can now pay between Rs. 1,08,000, 60,000 and Rs. 18,000 more will have to be spent, so that the rent will be refunded as per the entitlement of the unused portion. LTC.

Similarly, government employees will have to spend the equivalent value of the encashment to get a refund, in order to get a 10-day refund of the leave travel encashment available under the LTC package.

"Those funds will dry up for the LTC money travel sector of government employees to buy consumer goods. In addition, it will also send a vote of no confidence to the tourism and hospitality industry, which wants to get back on its feet." As planned, it will also cut money for next year’s future travel demand source, when the LTC block ends in 2021, ”the Federation of Associations in Indian Tourism and Hospitality (FISH) said in response to the government’s announcements on Monday.

Central Government employees get LTC in 4 year block (one for anywhere in India and one or two for one home). The right to air or rail fare, as per pay scale, is reimbursed and in addition, the leave amount of 10 days (pay + DA) is paid.

The government has approved a compensation scheme for LTC, as due to Covid-19, employees are not in a position to get a full quota of LTC in the current block of 2018-21. But this additional cost without actual travel under the new scheme will boost demand ahead of the festive season.

Under the new scheme, LTC returns will only be considered when goods or services with a share of 12 per cent or more in the GST rate will be spent. Therefore, LTC will refuse to spend on food articles to claim compensation. Further, compensation will be given only after the GST vouchers are provided by the employee.

To be eligible under the scheme, the employee has to choose both leave encashment and LTC. Compensation under the scheme also depends on the expenses incurred by the individual. Therefore, if the full quota of expenses is not met, the payment will be calculated based on the actual expenses. But in any case the actual level of cost should be higher than the LTC and encashment entitlement.

The full tax benefit will be given on the full quota of the tenant under the LTC while the leave will be taxable on separation. The government will amend the income tax rules to allow tax exemption on perceived travel expenses of employees.

No comments:

Post a Comment

Note: only a member of this blog may post a comment.