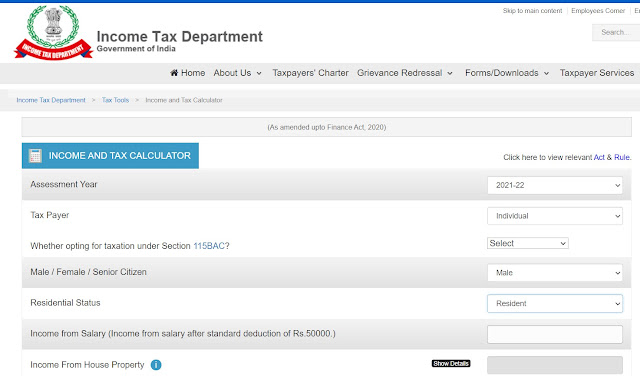

INCOME TAX CALCULATOR-2020-21

INCOME TAX CALCULATOR-2020-21 BY Jagadish Patel.

Income tax assessment for the year 2020-21

Download Incometax Excel file and open it in computer.

Systematic step-by-step understanding of the notable slaughter-reduction camp * Friends, the change camp will be held on 26/10/2020 according to the change amendment rules of the current year.

* Pay Camp Internal Camp Matter *

A. Schools with less than 20 in Std-6 and a combination of Std-6 and 7 with less than 20 will merge into nearby schools

B.

The children of Std-6 and 7 go to the school where the children go to

the upper primary section so the seniority of the additional teacher

accompanying the children is not eligible to be counted in the merged

school so that the teacher of the merged school will be considered

killed.

C. The right of the first mother school will be given to the

teacher who goes to the salary center in the internal camp of the salary

center. Even if a teacher who has been killed earlier has a maternity

leave in another pay center from the pay center, it is not available.

But if the camp of the pay center is completed and the camp of the whole

taluka starts and there is a vacancy in his own school in the pay

center, then the teacher who has gone out of the pay center is entitled

to the mother school.

D.

After giving the right to the mother school, the teachers of the

primary department of their own pay center will be given the right to

choose the vacancies of the primary department. Thereafter, if the

vacancies in the primary department do not remain vacant, then the

teachers of the primary department in the vacancies of the upper primary

will be ordered to be promoted in the upper primary department. The

teachers who get such an order will also be called back to the massacre

camp in the establishment of August 2021 as a teacher. If these

teachers graduate and offer an option in April-2021, they will be able

to go to the upper primary as a subject teacher in the option camp to go

to the upper primary based on the vacancy in their mother school.

Income tax assessment for the year 2020-21

Download Incometax Excel file and open it in computer.

E.

If the teachers who have taken the option are in the majority, then the

teachers have been transferred to the upper primary section by

relinquishing their right to the primary department. The option date of

the teachers who have been given the option will be considered as the

date of joining the upper primary section. As the date of joining HTAT

is considered as the date of joining the HTAT promoter, the option taker

cannot claim the right of seniority of the primary department by

getting the right in the higher department.

F. If a teacher has been

transferred to his / her pay center for medical reasons, even if he /

she has been in school for three years from the date of attendance, he /

she is not eligible for transfer.

G. If a teacher in his pay center

is the widow of a National Security Force employee and is responsible

for children and family, he should be treated as per Rule-2 (1) of the

Gazette of Government of India dated 04/10/2012 and subsequent

amendments of Government of India There is no provision to change it as

per the orders.

Accordingly the internal camps of the pay centers are completed.

* Inner camp inside the taluka *

A.

If no vacancy teacher is found in the vacancies of the higher division

after filling up the vacancies within the primary department of all the

pay centers of the taluka, then appointment order for the teachers of

all the vacancies in the vacancies in all the vacancies. Will be given

which will be counted in the new establishment next year.

B.

There is no provision in the circular to bring back the teachers who

have gone out of the taluka as higher teachers in the upper primary

section for the benefit of the mother taluka even if the vacancies in

the upper primary department increase. . Matru taluka no camp starts

and at that time only if there is a vacancy in the primary department of

a teacher's mother school, the benefit will be given to the teachers

who have left the taluka of the mother school.

C.

Accordingly, after the completion of the camps in each taluka, if the

number of teachers in the district increases, the proposal will be made

to the office of the Director of Primary Education, then we are bound to

follow the instructions given by the office of the Director.

* Special things to understand *

Recruitment

and transfer camp is a regular process. The only advantage is that no

one is allowed to walk in the regular process. What issues come out

today

1. Keep the camps closed due to lack of camp corona and give

letter pad. Friends used to say that campo should be done. Now you say

campo should be closed. Camps are the same every year. Friends, in many

schools there are more teachers when there is less work. On the other

hand, in schools with small omissions, if the paperwork is waiting for

the teacher to satisfy the hunger for learning, then there should be a

camp. * Nation or interest, education * is our first job, then there

should be a camp.

2.

It is totally wrong that there is a cry of seniority in the primary

department of teachers with options. If you want to maintain seniority,

stay in the primary department. Do you work in the higher department?

Should be done

3. If the teachers coming from the district fair also want to stay with the family, then it is also appropriate to have some vacancies according to the percentage to bring them.

Income tax assessment for the year 2020-21

Download Incometax Excel file and open it in computer.

INCOME TAX CALCULATOR-2020-21 BY Jagadish Patel

IMPORTANT LINK.

There

are so many things to understand, friends. Everyone should always be

given the right according to the policy. We cannot benefit from both

milk and curd. If we gain something, we have to lose something.